TNUoS charges set to surge: What NESO’s latest forecast means for the energy sector

30th September 2025

“We’re seeing the cost of grid transformation land squarely on suppliers and consumers. While the investment is essential, the current system lacks the predictability and transparency needed to support long-term decision-making, especially as NESO expect substantial change to the charging methodology with REMA and the reform of national wholesale pricing.”

Following NESO’s latest five-year forecast for 2026/27 – 2030/31 published on 18 September 2025[1], the energy sector is bracing for a major shift in Transmission Network Use of System (TNUoS) charges. With costs set to rise sharply from 2026, suppliers and consumers alike will feel the impact. In this article, we break down what’s driving the increase, what it means for bills, and how upcoming reforms could reshape the way we pay for our electricity network. Whether you’re a generator, supplier, or investor, understanding these changes is key to navigating the next phase of the UK’s energy transition.

What is TNUoS?

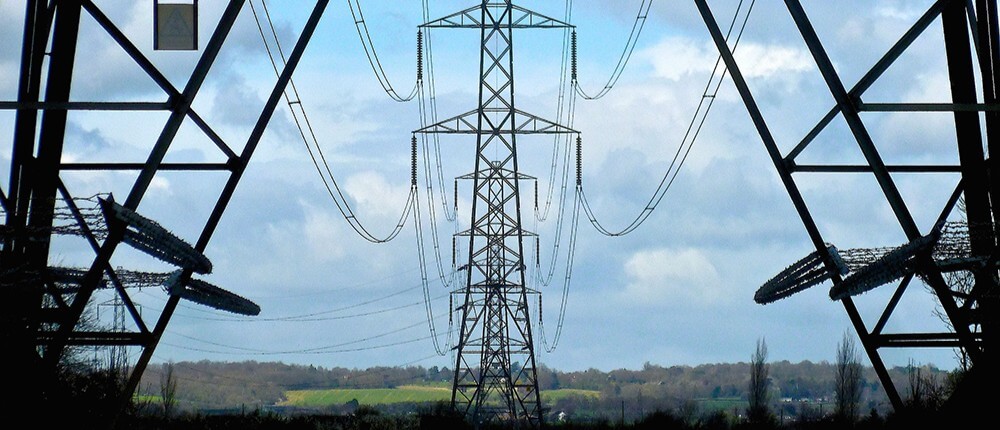

Regulated by Ofgem, TNUoS charges fund the transmission network—the high-voltage backbone that moves electricity across the country from generators to local distribution networks. These charges are used to recover the costs associated with the installation and maintenance of the UK’s transmission system. Suppliers and generators connected to the transmission network pick up the bill for this but, inevitably, this cost is passed down to consumers.

Though there is some regional variance, for consumers, these charges account for around 5% of your electricity costs. The remainder of the TNUoS charges are recovered from a uniform, national standing charge, the cost of which is dependent on the size and voltage level of a site’s connection.

NESO’s five-year forecast: what’s driving the increase?

NESO’s latest five-year forecast confirms what many in the sector have been anticipating—TNUoS charges are set to rise sharply. Total revenue to be recovered in 2026/27 is forecast at £8.9bn, climbing to £13.6bn by 2030/31. While generation tariffs are expected to fall slightly over time due to a growing charging base, demand-side costs will increase significantly, with the average household TNUoS charge forecast to hit £93.48 in 2026/27, making up over 10% of the average electricity bill.

The shift to a mosaic of smaller and decentralised generation sites—especially wind in Scotland and the North—means that our electricity needs to increasingly travel longer distances. That requires major upgrades to the aging transmission network with transmission owners proposing a need for £80 billion in investment over the next five years to fund these improvements. With the government’s Clean Power 2030 target looming, Ofgem is keen to ensure that the transmission charging regime doesn’t become a barrier to investment in low-carbon infrastructure. NESO’s forecast reflects this and, whilst the rising costs are unwelcome, they are demonstrative of the scale of investment needed to modernise the grid and support the UK’s net zero ambitions.

The forecast also highlights that locational tariffs are becoming more polarised, particularly in Scottish zones, and this is being driven by north-south power flows and the introduction of new HVDC links. NESO has recalculated several parameters ahead of the RIIO-ET3 price control period, including local substation and offshore tariffs, and updated its transport models to reflect the latest network data. However, many methodology changes—such as those proposed by the TNUoS Task Force and various CUSC modifications—are still in progress and not yet reflected in the forecast. NESO acknowledges the uncertainty this creates and encourages industry engagement to shape future reforms.

Ofgem’s call for reform: aligning investment with grid capacity

In response to growing concerns over the volatility of TNUoS charges, Ofgem issued an open letter in July[2], calling for an evolution of TNUoS charges to support a more efficient, strategically planned energy system. Ofgem’s goal is clear: guide investment, generation, storage, and demand to locations where grid capacity will be available in a bid to reduce congestion and, ultimately, cut costs for consumers.

Ofgem proposes that future network charges should send stronger locational signals aligned with the Strategic Spatial Energy Plan (SSEP) and Centralised Strategic Network Plan (CSNP). These plans will map out where energy assets should be located to optimise the system. A reformed TNUoS methodology could reflect expected spare capacity, encouraging developers to site projects where they’re most needed—rather than where they’re cheapest to build today. This marks a shift from reactive, year-on-year pricing to forward-looking, strategic investment guidance.

The letter also acknowledged how one of the biggest challenges with the current TNUoS regime is its unpredictability. Ofgem has recognised that volatility in charges can hinder investment and increase consumer costs. To address this, they’re exploring options like fixing charges at the point of investment or sending locational signals through deeper connection charges. These approaches would give investors greater certainty over lifetime costs, helping to de-risk projects and support the delivery of Clean Power 2030.

Beyond generation, Ofgem is also considering how to incentivise smarter siting of demand and storage assets. Projects like hydrogen electrolysers, batteries, and data centres could be rewarded for locating in areas with excess renewable generation—such as Scotland—rather than adding pressure to already congested parts of the grid. It is envisaged that this could be achieved through targeted transmission or connection charge discounts.

REMA and Government’s vision for TNUoS reform

As part of the Review of Electricity Market Arrangements (REMA), the Government has committed to reforming TNUoS and connection charges to better support strategic system planning and efficient siting of new generation. A Reformed National Pricing Delivery Plan is expected later this year, with legislation to follow. The aim is to deliver TNUoS reform by 2029 at the latest, with Ofgem leading the design and implementation in close collaboration with Government and NESO.

Key goals include:

- Making TNUoS charges less volatile and more predictable.

- Ensuring charges reflect long-term system benefits.

- Sending clearer locational signals to guide investment.

- Avoiding the complexity and risk of zonal markets.

The timing and transparency of cost recovery are critical—both for consumer fairness and supplier certainty. Ofgem’s upcoming cost allocation review presents a key opportunity to address these issues.

The price of clean and efficient energy

Upgrading Britain’s transmission network isn’t just about keeping the lights on—it’s about unlocking the full potential of our low-carbon future. Strategic investment will allow the system to make better use of existing and planned renewable generation, reduce overall system costs, and support emerging markets that reward flexibility from generators, battery operators, and consumers. It also helps minimise outages and improve system balancing. Without these upgrades, the UK risks relying more heavily on gas-fired generation near demand centres—an expensive fallback that could lead to higher operating costs and curtailment of clean energy.

So while the upfront costs are high, the aim is to build a grid that can deliver clean power efficiently and reliably. The hope is that short-term investment will lead to long-term savings and a more resilient energy system. The energy sector is undoubtedly entering a period of rapid and widespread infrastructure investment and regulatory reform[3][4]. As decisions are made, transparency and early engagement with industry and consumer groups will be key to ensuring that cost recovery is fair, manageable, and aligned with the sector’s long-term goals. Stakeholders across the value chain—from suppliers to investors—will need to stay engaged as reforms progress and forecasts evolve.

TNUoS charges: How we can help

With TNUoS charges rising and reforms accelerating, now is the time for stakeholders across the energy sector to engage. Whether you’re a generator, supplier, investor, or developer, understanding how locational signals, connection charges, and strategic planning will shape future costs is critical. Ofgem and NESO are actively seeking industry input, and decisions made in the coming months will influence the regulatory and investment landscape for years to come. Early engagement can help ensure your interests are represented—and your projects are future-proofed.

Our Infrastructure and Energy team is closely tracking developments in the reform of the TNUoS charges. Our specialists can provide advice and support to clients looking to better understand the implications of such reforms. Specifically, we can:

- Assess the impact of TNUoS changes on your business model, contracts, and investment strategy.

- Navigate regulatory engagement, including responding to consultations and participating in code modification processes.

- Help you align your projects and bids with emerging locational signals and strategic planning frameworks.

- Advise on connection agreements and charging methodologies, including transitional arrangements and risk mitigation.

- Help you understand, apply and stay up-to-date with, legal and regulatory developments.

- Provide legal and practical advice and support in relation to transmission of electricity, as well as related statutory consent and planning applications

- Provide commercially-focused, cross-disciplinary advice and transactional assistance in connection with infrastructure and energy developments and financings.

- Help secure grant funding, including ‘green finance’, or other responsible investments to fund infrastructure and energy developments.

- Provide risk management and effective dispute resolution strategies if/when any transmission or related network issues do arise.

If you’d like to discuss how these changes might affect your organisation or project, contact Ben, Sophie, James, or any member of our team.

[2] Open Letter: Reforming network charging signals to align with the Government’s decision on the future design of Great Britain’s electricity system

[3] Grid connection reform: Accelerating demand side projects – Walker Morris

[4] Heat networks: Government proposals for regulation – Walker Morris

“This sharp rise in TNUoS charges reflects the scale of investment needed to deliver the UK’s net zero ambitions. But the pace and volatility of these changes are making it increasingly difficult for suppliers and investors to plan with confidence.”

James Blocksidge, Associate, Infrastructure & Energy